An ink-receiving layer is added to Mitsubishi’s HiTec Jetscript high-speed inkjet papers

The right type of paper at the right price is fundamental to success in high speed inkjet printing. Simon Eccles suggests that mill-treated papers may be the best choice.

In September’s Digital Printer we considered the requirements of papers largely from the press and ink manufacturers’ viewpoint. This time we’ve been talking to paper manufacturers with high-speed inkjet products: Mitsubishi Paper HiTec Paper Europe, Crown Van Gelder and Mondi, about how they are developing mill-coated papers to meet the challenges of high-speed inkjets with aqueous inks.

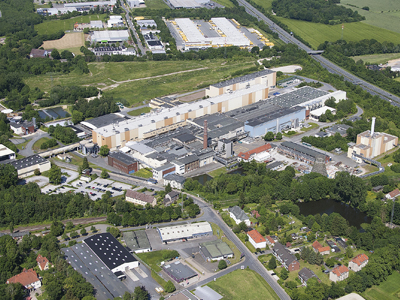

Mitsubishi HiTec Paper was an early entrant into the market, offering papers for continuous inkjet printers in the mid 2000s. All but one of its current Jetscript range is made in its Bielefeld Mill in Germany. These special coated papers established a reputation for excellent quality and drying, but at prices that had manufacturers and users looking for cheaper alternatives. This usually means either a pre-print primer or ink resin additives for high quality colour work, which themselves increase consumables costs.

Ralph Buhl, marketing manager for Mitsubishi HiTec Paper, says, ‘All our Jetscript high-speed inkjet papers are coated with an ink-receiving layer. Of course this has a certain higher cost compared to treated or uncoated papers, but there are benefits in print imaging, print densities, ink saving possibilities, as well as higher speeds during production due to fast drying. We continuously optimise our media to remain competitive for high quality print jobs.’

Mitsubishi HiTec’s mill at Bielefeld, Germany

This includes working with the press and ink developers, he says. ‘One of the most essential parts of our product development and product implementation work is the cooperation with the original equipment manufacturers to test our papers for ink compatibilities. We generally go for production tests, which include profiling of our paper to the machine settings. We also conduct tests with several finishing equipment manufacturers for smooth runnability on their finishing machines, for folding, cutting, and so on.’

Mondi is a large Austrian-based paper supplier with a significant presence in digital papers, including inkjet. Christina Fadler, communications and events manager for Mondi Uncoated Fine Paper, says, ‘We have been working closely with all major inkjet printer OEMs since we started to develop papers optimised for various high-speed inkjet printing presses.’

A swell time

An example is the Christian Doppler (CD) Laboratory for Fibre Swelling and Paper Performance, run in co-operation with Canon Océ and Graz University of Technology in Austria. This is investigating swelling and de-swelling processes during paper production, printing and converting.

Ms Fadler explains the way inkjet papers are formulated: ‘At Mondi, we apply a treatment which reacts with the colorants in the ink and we broadly distinguish between slightly treated papers, fully treated papers and pigmented papers.’ Treating pigmented papers costs ‘a little more,’ she says. ‘Our aim is to provide an overall commercial benefit to the printer, either by allowing an ink reduction during printing or by superior quality when compared to untreated papers – thus allowing the printer to earn higher margins.’

Crown Van Gelder (CVG) is a small-to-medium sized paper manufacturer, based in the Netherlands. It was an early entrant into the inkjet market and its current extensive LetsGo High Speed Inkjet range includes variations of matt, silk, bright and high performance grades for various colour quality needs, with pigment and dye ink versions.

‘We work closely with all printer manufacturers like Canon Océ, HP, Ricoh, Screen, Xerox Impika, Memjet, Domino and Fujifilm,’ says Jan Rops, inkjet product manager. ‘It is good for them and for us. By working and testing together we know that our customers will get the maximum print result on our papers. As we have tested all our papers at the different OEM printer manufacturers, we know what works best. We also help our customers with colour management and we can make customer specific colour profiles.’

Totting up the cost

Are costs coming down? ‘Treated inkjet papers are a bit more expensive than standard woodfree uncoated (WFU) papers,’ Mr Rops says. ‘Prices have come down, but the treatment has its cost. Though you should look at the total cost of print rather than the cost of the individual components of the print process. Printing on treated inkjet papers is more economical than printing on standard WFU uncoated papers which are off-line primered or have a bonding agent applied, especially when colour is used. Treated inkjet papers offer better print quality, better layflat-ness and better runability. Also cleaning and maintenance cost are lower. A glossy coated inkjet paper is more than double the price of a standard glossy coated offset paper. Only specific print jobs are printed on this type of paper. In the high end, which needs gloss, a lot of developments are going on.’

The suppliers we talked to here aren’t the only ones with digital papers of course. For instance Felix Schoeller Group in Germany introduced its Jet-Speed continuous inkjet papers in 2015. They use HP ColorPro technology to print on HP’s PageWide T-series web inkjets without bonding agent primer. Stora Enso offers two classes of reel-fed inkjet paper, BergaJet for books, catalogues, direct mailing, manuals and transpromo work; and SuperiorJet, a bright white paper for higher quality applications including books and brochures.

Sappi, which announced its Jaz range of high speed inkjet papers with a splash in 2011, quietly discontinued them about 18 months ago and now concentrates on dry and liquid toner (HP Indigo) papers. Jessica Resen, a paper consultant with Italian Fedrigoni, says there are no plans for inkjet papers to join the company’s HP Indigo papers.

Most high speed inkjet installations remain continuous feed types, but sheet-fed production presses are coming through. Fujifilm’s B2 Jet Press 720S has a resin coagulant in the ink to allow the use of uncoated papers, so paper suppliers’ attention seems to be concentrated on the Canon Océ Varioprint i300/i200 and the Xerox Brava, which are roughly SRA3 sized. Mondi provides cut-sheets for both presses, while Mr Rops at CVG says that Canon Océ takes its rolls to offer pre-cut sheets to its i300/i200 customers.

One prominent UK paper dealer we spoke to said that the company is looking carefully at cut-sheet inkjet production presses but is reluctant to offer an extensive stock while the installed base remains small yet has varied needs for coatings. While the presses and ink tend to get the lion’s share of attention in high-speed inkjet, it’s clearly worth looking at the paper choice too.

Read the full November issue of Digital Printer here. Subscribe to the magazine for free – register your details here.