An MIS can help a printer gain business intelligence

Some MIS developers offer business intelligence tools as a module or add-on, while others think that’s the whole point of their offering. Michael Walker put on his thinking cap to see how it can help your business.

Business intelligence (BI) had its genesis in the world of big data. A general definition found online said it is ‘an umbrella term that refers to a variety of software applications used to analyse an organisation’s raw data. BI as a discipline is made up of several related activities including data mining, online analytical processing, querying and reporting’.

Not much of that sounds like print, yet printers, just like any other businesses, create and collect data continuously, whether they realise – or analyse – it or not. The data relates to estimating and orders, production time, material, labour and energy costs, overheads, invoice values, lease payments and deprecation and other financial aspects of the business.

‘Business intelligence is what happens when you take lots of data, analyse it and turn it into useful intelligence that can help you make key business decisions,’ said Keith McMurtrie, Tharstern’s managing director, adding, ‘Note the difference between data and information – it’s a big one. An MIS holds lots of data, but traditionally it’s been pretty hard to extract it and turn it into useful intelligence.’

EFI, which offers business information modules to complement its Radius and Monarch MIS software, would agree, and claims that doing so can achieve greater efficiencies, improve profit margins, better satisfy customers, allow print service business to plan more strategically and to identify new revenue opportunities.

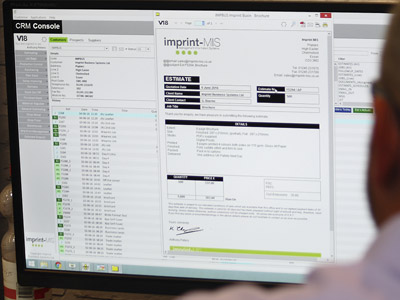

A lot of this sounds like management information system (MIS) territory and vendors such as Imprint MIS argue exactly that. ‘Business intelligence is what you get from MIS. Understanding your business is the sole purpose,’ said Wayne Beckett, Imprint’s sales and marketing director. Trevor Cocks, managing director of Accura, agreed, ‘The MIS is the BI, or at least the reporting aspect.’ Steve Richardson, sales director at Optimus, concurs, he said ‘It’s an intrinsic part of the offer’, but also points out that Optimus also offers third-party tools such as IBM’s Cognos for more complex database work.

Face forwards

One difference between BI and MIS may be temporal. Anthony Thirlby, Heidelberg’s general manager for Prinect, suggests that most MIS is based around a historical view of a business, while BI is more concerned with planning for its future.

Anthony Thirlby, Heidelberg’s general manager for Prinect

‘MIS providers react to their customers’ needs. BI leads customers in terms of increasing capacity and maximising sales opportunities and conversions. It’s a financial and sales stimulator,’ he said. ‘People focus on the transactional part, there’s no management time to shape a strategy to focus on the markets they want to attack. BI creates a platform for sales people to see the process six, 12, 24 or even 48 months ahead.’

While crystal ball gazing even six months ahead might seem unlikely for some, Thirlby said that the ability to look daily at the company’s trading status brings predictability; if MIS is generally about estimating and transactional aspects of the business, BI is there to address the gap in the financial analysis, particularly important if the sales and conversion process is changing rapidly.

EFI’s Nick Benkovich, senior director, EPS Portfolio Product Management, points to one of the ways in which that process is changing fast, thanks to the increasing number of technologies that many print businesses now support.

He explains, ‘As margins erode and businesses diversify, questions like ‘is this the right kit – or customer – to invest in?’ become critical. If a commercial printer diversifies into wide format, do they know which products or lines are performing? People tend to focus on the $2 million per year customers, but the $750k ones might be making them more profit.’

Mr Beckett supports this, saying, ‘Some customers dropped whole job ranges after seeing their MIS reports.’ He adds that ‘losing’ jobs in the system is particularly likely in web to print driven short-run, low margin work.

—

Read the full feature here