Economic undercurrents and a mature market for digital equipment mean that finding the funds to grow is easier than you might imagine.

Back in the day presses were not just production tools, they were also a pension. The residual value in the iron was enough to enable you to sail into the sunset once you had downed tools for the last time. Digital printers are different, they are built more like the IT kit they are closely related to, and subject to a similar rate of obsolescence. While you may not upgrade a digital press as often as a phone or tablet, it can feel more like that than a venerable litho machine putting in decades of service. That is one of several challenges that have made funding digital kit difficult. For the lender it did not look attractive. Rapid obsolescence meant no residual value and a small and unproven market meant lots of risk, two things that give lenders the fear. Then the sky fell in in 2008 making everyone even more cautious. That has changed.

‘The appetite for lending is reasonable at present, there are a number of funders keen to grow their portfolio’s and therefore some very commercial rates and structures are available,’ said Compass Business Finance director Jamie Nelson.

Mature markets

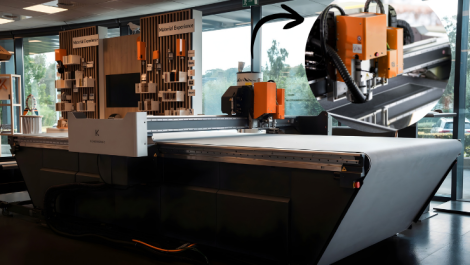

The market has also moved on too, toner technology is stable making it less vulnerable to a radical change and the price of machines has come down. ‘When a digital press was £300,000 it was hard for a jobbing printer to make money,’ said Paragon Bank sales executive Paul Eversfield. ‘We’ve seen a lowering of the price points and a plateau of development, which has reduced entry cost and risk and for a lender it makes it easier to take a view.’ Wide format too is an area that lenders have learnt to love.

According to Mr Eversfield: ‘The machines are built to last, inkjet in that sector is well developed and the work has good margins. Also because there is a wide variety of applications there is a ready market for secondhand machines.’ But what about the emerging commercial digital markets such as B2 and B1 cut sheet machines, continuous feed presses and all things inkjet? ‘We’re starting to see inkjet coming of age,’ said Mr Eversfield. ‘It is still high depreciation. It is encouraging that manufacturers with a long history and a good reputation are embracing digital technology. The problem currently is that the price point for these bigger digital machines is high. It’s like it was in the early days of digital – it makes it a struggle for the buyer to make money.’

Worth the paper its is written on

It is not just the printing equipment that needs to be considered. Fortunately finishing kit, digital or not, is favoured by financiers as it is generally built to last and holds value. The increasingly important software packages including workflow, MIS and web to print are assumed to be more problematic but there are options, even without putting everything in the cloud and renting it. Because software, especially anything such as MIS or web to print, which are likely to have been customised, has no residual value lenders will want some alternative security. It may require a directors’ guarantee, which is not as onerous as

it sounds.

‘People assume it means chucking their wife and kids out onto the street if it goes wrong,’ said Clear Asset Finance agent Katie Dowse. ‘It doesn’t, essentially you sign a piece of paper that says you have faith in your business and will support the debt if anything goes wrong.’

Understanding what financiers want from you is only half the story; to get the best advice and the right deal it is also important to understand the different options available and to pick the right partner. In fact, according to Mr Nelson, ‘This is probably even more essential in the digital market with various types of facilities and structures as well as the presence of ‘in house’ funders, it is critical you understand what you are signing up to.’

What are the options?

Two of the most obvious options are go to your bank or take the offer from the equipment vendor, be it the manufacturer or the dealer. However, they are not the only options, and industry specialist lenders and brokers may provide a better alternative. Their understanding of both the print and finance industries can be invaluable.

It is often easier to secure vendor-backed finance, but the specialists argue that this sweetness at the beginning of the deal may turn sour at the end.

‘What happens at the end of the term is dependent on the type of finance that is taken out,’ said Mr Nelson. ‘Customers need to be careful, as an independent we work for the benefit of the business buying the machine, it is not always the case for dealer led finance arrangements. Their priority is to provide a service to their supplier and may well pass title back to them.’

On the other hand regular banks without print-specific knowledge maybe more reluctant to lend than a specialist with a deeper understanding.

‘As an independent sector expert with years of knowledge we can often tell whether it is a good risk, even if it may not look the best on paper,’ said Mr Eversfield.

Mrs Dowse added: ‘A good broker can help to find the right funder if the business situation is complicated or you need specialist equipment.’

Digital equipment is not necessarily difficult to fund but it is different. Understanding the differences and exploring the options available can ensure that you can access the cash you need at a lower cost.