Up in the Atrium at the entrance to Messe Dusseldorf during drupa was a captivating paper sculpture designed by Barcelona-based paper sculptors extraordinaire Wanda. French finishing firm Maison Lack laser cut the 15,000 elements out of Arjowiggins paper using its Highcon Euclid.

Now the chance to ‘touch the future’ is past, it is time to take stock and see what stood out on the show floor.

drupa’s epic scale makes the process of reviewing the event difficult. Even if you were to spend the whole time at the show and planned your time with military precision it would be impossible to see everything on display. So this review comes with a caveat that it is not, does not and realistically cannot attempt to be definitive. What it does do is highlight some key themes and to drill down in depth into some topics, technologies and products that seem pertinent.

Still fit for purpose

Inkjet may dominate marketing messages but in reality toner is still holding its own. Inkjet is the centre of attention in many markets because it immature and vendors are trying to build awareness and understanding. Back 10 or 15 years it was the same situation with toner-based technologies vying for attention against offset. It can be easy in all the excitement of the latest developments and crystal ball gazing to overlook the bread and butter technology and the incremental enhancements to it that are likely to deliver easier to implement business improvements. HP Indigo general manager Alon bar Shany claimed that Indigo is ‘still young’ as a technology and said that the developments at this show represented ‘the most significant refresh in 20 years’.

‘There will still be room for toner technology at least five years from now,’ said Canon Commercial Print Group director Peter Wolff. Likewise, Xerox’ president of Global Graphic Communications Operations Andrew Copley, said: ‘We see a lot of growth and innovation in toner, we see opportunities there.’ Backing up those words with numbers Ricoh sold its 300th c9110 during that show and Heidelberg sold its 1000th Linoprint/Varypress with all signs that its sales are growing with an expectation to sell 450 next year.

The next Nexpress

Kodak’s demonstration of a new Nexpress Max platform, due next year harks back to the original promises that it was the best of digital and offset. The ability to switch the unit order around, especially with the addition of the high opacity white toner, provides benefits for labels and other applications where you want to put white down first. Other offset-like features include the ability to slow down to enable a particularly tricky job; a reflection that print is still a craft process, especially for high value applications. Providing control of the variables can eke out the most of artwork and materials.

Kodak’s Nexpress MAX Platform

Long sheets for all

Longer sheet/banner handling has been a trend in the two-page/SRA3 toner market for several years. At this show the key trend was the industrialisation of long sheet handling with the BDT Tornado being the feeder of choice for Canon, Kodak and Ricoh. For many firms this may prove to be a more affordable and attractive alternative for producing 6pp plus and landscape format documents than a B2 press.

Special effects

Kodak’s use of digital white

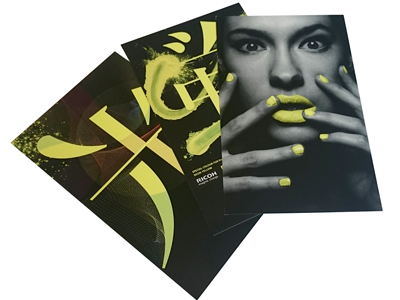

An increasing number of special effects and special inks were in evidence. Kodak introduced a white. Ricoh and Heidelberg showed neon yellow alongside clear and white on the 7100/VaryFire, while Oki also launched neon toners.

Ricoh’s yellow neon on the 7100/VaryFire

HP Indigo showed effects that it is working on in the labs, soliciting feedback about which ones commercialise. Alongside its long-promised silver ink were scented varnishes, glitter, self-expanding inks, a conductive ink using carbon nanotubes and a rub remove ink for the likes of lottery tickets. One of the most interesting was a printed lenticular lens. Ricoh showed some impressive samples using white ink and digital foiling, with a Kurz DM liner on its stand to provide the foiling and Color Logic software to produce colour over foil artwork.

White ink and digital foiling by Ricoh

Larger format digital

Four years ago one of the major developments was B2 digital, in particular HP Indigo’s launch of its B2 10000 and the KM-1/Komori Impremia LS29, which joined the Fujifilm Jetpress 720 and the Screen Truepress Jet SX unveiled in 2008. In the intervening years it has been HP Indigo and Fujfilm who have made the most sales. This time around most of the developments are evolutionary rather than revolutionary. HP used drupa to launch the Indigo 12000, an enhanced version of the 10000 and Konica Minolta and Komori are now selling their B2 machines, as is Delphax with its Elan.

Discovery of Voyager

One surprise in the B2 arena at drupa was Canon’s technology demonstration, the Voyager. This is a water-based machine, which runs at 3000 B2 sheets per hour. The machine is a large stealth-black box sitting between the feed and delivery of a conventional offset press. Samples were behind glass, the quality of images was high, although text showed halos that may have been some sort of paper treatment. There is speculation that the Voyager uses an offset process, which would put it in a similar class to Landa’s Nanographic presses, however, Canon has not clarified the technology used.

Five into (B) 1

In the B1 market things are less evolved. Heidelberg, Komori and Landa had all pre-announced their B1 plans, which were on show. Two new concepts were announced but not shown, the KBA VariJet 106, a B1 inkjet machine developed in partnership with Xerox, and Konica Minolta’s KM-C, a B1 carton press.

Konica Minolta revealed little about the KM-C, except to say that unlike the KM-1 the paper transport is self-developed, rather than being supplied by Komori. Given that other vendors have chosen to partner to meet the not inconsiderable challenges of combining inkjet and paper transport at larger sheet sizes, it adds to the challenges for Konica Minolta.

KBA has the advantage of market knowledge in packaging, the target market for the VariJet, with 70% of its sales in the sector. The firm’s consultations with customers about their needs has led to a concept that is very different to other inkjet presses in that it is extremely modular with options including corona treatment, primer, opaque white, digital, offset, cold foil and potentially screen printing and rotary die cutting.

‘Folding carton is complicated, so we had to have a smarter solution,’ said KBA chief executive of digital and web Christophe Müller. ‘We think there is a big market and that it is a smart solution to combine these technologies.’

The inkjet part of the press will run at 4,500 sheets per hour at 1440 dpi using new water based ink. KBA expects the machine, which has been under development for two and a half years with two prototypes in the lab, to be commercially available in 2017. You can not argue with customer requirements for an integrated production line, and that is something KBA is experienced in. However, integrating so much technology, especially an immature process like B1 sheetfed inkjet, is a big challenge.

Prime time

Taking centre stage on the Heidelberg stand was its B1 inkjet press, co-developed with Fujifilm, the Primefire 106. It was running and the quality was good, although samples were unavailable to take away. Details of the delivery, under wraps when it was first shown to the press in February, were revealed. There are two delivery stacks, one for good copy and one for any that the on board sheet scanning system rejects. It is significant that in addition to installing a closed loop control system to ensure maximum image quality Heidelberg recognises that there will be some sheets that do not make the grade, and therefore need to be separated from good copy automatically.

Jason Oliver from Heidelberg presenting the Primefire 106

The initial market will be for short run work, primarily packaging, with a sweet spot of up to 1000 sheets and a monthly production volume of 1.5 m sheets. Pricing was confirmed at €2.8m for a seven colour plus varnish machine, pricing for ink and service has not been disclosed. The first beta site, which is expected to begin at the end of 2016 will be ‘a German speaking site’, followed by commercial deliveries in 2017.

Benny and the jets

Landa Nanography made three bold claims – fastest, highest quality and lowest cost, so after its second drupa how do the claims stack up? In terms of pure mechanical speed, the 13,000 sheets per hour claim is without doubt the fastest B1 cutsheet inkjet machine. However what is missing is a figure for uptime/availability. Heidelberg is promising a figure of up to 80% for the Primefire 106, albeit at a much lower mechanical speed of 2000 sph. Ultimately it is productivity rather than maximum mechanical speed that is important. In Landa’s favour is that it is committed to making sure the technology can deliver before making it commercially available.

As Landa will not talk economics, except with prospects well engaged in the sales process it is impossible to assess. It proposes a click-based model rather than one where you buy the ink as a consumable, which does reduce the ability to control your own costs. Under pricing the click by underestimating the average coverage would jeopardise Landa’s profitability, so a click-based model is unlikely to be the most favourable to the printer. It all comes down to odds and percentages, and in this game of chance Landa is the house, and the house always wins. Rivals are also opaque in their discussions of the costs.

Quality is better than it was last time, but that is not saying much. The samples on show were poor. On the plus side, colours were very vibrant, as promised. But there were a lot more negatives than positives, with banding and mis-registration. When this was put to Benny Landa he explained: ‘With the 11 m long belt/membrane you will never get perfect registration mechanically, it relies on the electronics. Our registration is all-electronic but it is not implemented on the machines at the show. ‘AQM [the automated quality management system that combines AVT’s Jet-IQ inspection system with the EFI Fiery controller] will sort out the dropped nozzles, the inconsistency and the mis-registration electronically. We ran out of time for drupa. It will be there in a few months.’

Out of three claims, one holds up, one is unanswerable and one currently falls flat but a solution is promised. The beta sites and strategic partners announced at the show are impressive and give credibility. However, two, Elanders and Cimpress also placed significant orders at the show for other digital equipment. This suggests that while they see potential they are not willing to wait forever, or put all their eggs in one basket. Time may not be on Landa’s side. A key trend at drupa was advances in inkjet substrate flexibility, especially new inks and treatments that offer higher quality and coverage on standard offset stocks. Chemistry may solve the challenges of inkjet that Landa aimed to solve mechanically. Benny’s blanket could smother the project rather than providing security.

Credible ink

In continuous feed inkjet there were a number of incremental enhancements to machines, including enhanced running speeds and the addition of extra channels for special inks such as MICR or special colours. The most significant overall trend though was the widening application range, and in particular the development of new inks that promise to work on standard offset stocks, including coated grades. While there was no talk of reductions in the price of the inks themselves, which may still limit the applicability for high coverage applications, the ability to use standard media will reduce job costs. Screen was just one firm showing such an ink, and according to Screen Europe vice chief for sales Bui Burke: ‘This technology could be the breakthrough’.

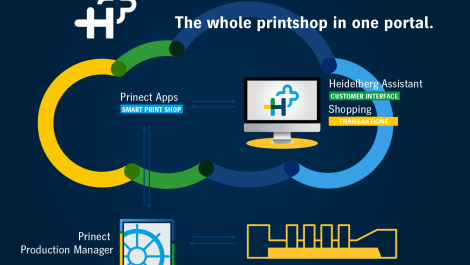

Beginning of the end

End-to-end (E2E) workflows and Print 4.0/Industry 4.0 were two megatrends at the show, with many vendors across the whole production chain showcasing a greater degree of integration and automation than previously. This time around there was much more evidence on the show floor of truly integrated processes rather than lip service to the concepts. Having said that, one of the most interesting developments at the show was the partnership between Fujifilm and Epac, which was not shown live but was being discussed.

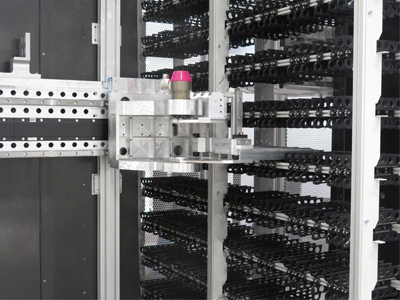

Epac is a Californian company that has been working on print production automation for over a decade, largely under the radar. Having started out as a book printer the firm morphed into a technology developer, especially after 2012 when it sold its book printing factories along with the rights to its technology for the production of English language books in several countries to Ingram. Epac’s technology combines software to manage production with materials handling, storage and robotics to completely automate the process from order to finished product. On display at drupa on the Fujfilm stand were two caged robots – looking like the offspring of Alien and Davros, styled by Apple. Currently the firm serves the top 1% of market, focusing on book production. With the partnership with Fujifilm the plan is to develop the technology to make it more affordable and relevant to a far broader range of applications and proportion of the print market.

Epac fully automated robotic production

‘Industry 4.0 is what Epac has been doing for 10 years,’ said Epac CEO Sasha Dobrolovsky. ‘We are working on a smaller version of the system that is applicable to 95% of printing companies.’

Fujifilm Global Graphic Systems director and vice president Takuo Ito added: ‘Short run is getting shorter and shorter, so there is a need to automate the total process and for that we saw Epac was the best partner. It is short run without compromise.’

At the heart of the collaboration will be Fujifilm presses. At the show the focus was on a digital web implementation of the Samba print head but the Jetpress 720S is also a possible part of the system. The firms are taking an open approach to finishing, which is likely to embrace multiple partners. Although its system is open Epac has ‘primarily worked to date with Hunkeler, Horizon and Muller Martini,’ according to Mr Dobrolovsky.

E-beam technology

With the inroads digital print is making into packaging food safety is becoming a crucial consideration, as can be seen with vendors opting for water-based formulations over UV for many inkjet machines targeted at packaging. There is an alternative, E-beam curing, as shown at drupa by ebeam Technologies, with a compact and lower cost e-beam curing system, suitable for mounting on narrow web (up to 40cm) machines. As a technology for curing inks E-beam is not new, and is used in flexo and gravure, however it has previously been too expensive for inkjet applications. This is due to the higher cost and complexity of the curing systems, even though the inks can be 20% cheaper than similar UV inks. With a potential price for a 40 cm system of €100,000 – still three times the price of a UV system – E-beam cannot be called cheap. However, the cost in use is less with lower energy costs and simpler, less expensive inks. The biggest benefits though are the potential of food contact safe output. It has been mooted that E-beam could be a replacement for all UV-curing, including wide format. The high hardware price and the inability to stitch together modules to increase curing width make that impractical.

It might seem strange to focus on a product that does not have mass appeal. There is, however, often as much value in taking time to understand, and then exclude, something that is not relevant to you as there is in focusing on something that is directly relevant. In this case a deeper understanding of E-beam curing quickly dispels thoughts that it is a panacea for all UV applications, and highlights that for many applications UV will continue to be the most suitable technology.

Fitness for purpose

It is a lesson that is equally applicable to any emerging technologies, including digital printing processes. Existing processes have their weaknesses, which can be addressed by new technologies with different capabilities. There is often plenty of developments that extend the reach and relevance of current technologies while new technologies have their own limitations and are unlikely to be all things to all people. In the context of drupa 2016 toner still has its place with potential for development and inkjet technology is here for an increasing number of applications and clearly has the potential to disrupt more in the future.