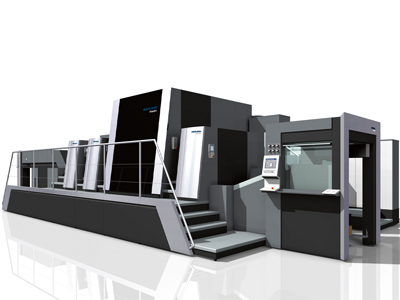

The Heidelberg Primefire 106

As the market evolves digital technologies are extending their reach with new applications for toner and inkjet. While that means a wider range of solutions it can make it harder to know what is right for your needs.

Drupa is nearly upon us and, unless we are blindsided by a completely new technology, it is fair to assume this time around will be evolutionary, as the big announcements of the last couple of events mature. You could moan that means it will be boring. On the other hand it is an opportunity to look closely at how products stack up commercially for particular applications rather than simply how they work and what they might be used for.

It’s complicated

Toner, and in particular liquid toner, showed a remarkable revival in fortunes at drupa 2012. Indigo’s larger format, Xeikon’s announcement of Trillium and Ryobi and Miyakoshi’s efforts all provided a shot in the arm to a process some had written off as ultimately dead in the face of inkjet’s unstoppable advance. A further wrinkle was Heidelberg’s flirtation with the technology. While Heidelberg has subsequently thrown its chips on inkjet, the other firms have all advanced. This time around Trillium and Indigo are being positioned to tackle high quality high coverage applications that inkjet can’t address. This highlights the technical and economic limitations that still remain for inkjet, and the dangers of championing one technology over all others without taking a more nuanced view of each application’s needs and the relative strengths of each process.

Emerging tech

One of the key things about shows is a glimpse into the future with conceptual technologies and prototypes that are years from the market or may never see the light of day. At drupa 2016 there are three technological concepts worth looking at to see what might be. Two, Kodak’s Ultrastream and Xaar’s next-generation piezo drop on demand are developments on the theme of inkjet, while laser imaging, as exemplified by DataLase, is a different category altogether.

Ultrastream

It is more than a decade since Kodak first unveiled the Stream continuous inkjet technology at the heart of its Prosper presses. Over that time it has become clear that there are some unique attributes that are attractive for a number of applications. Kodak’s commercial woes may have made customers reticent about a fundamentally good technology. The right home for the Prosper business, with a strong commercial foundation and deep enough pockets to develop the concept fully, could make Ultrastream a serious contender worth understanding.

Laser Imaging

The evolution of lasers and breakthroughs in the underlying pigment technology, especially the potential for full colour, promise a huge expansion in the addressable market for firms such as DataLase. In addition to unlocking completely new applications laser imaging could provide an alternative to inkjet and toner in markets where they currently dominate.

If the next-generation piezo technology that Xaar is showing has as much impact as its 1000 series heads had in industrial applications, it is worth understanding this fundamental technology’s capabilities.

B1

Heidelberg and HP indigo (sort of) joining the fray alongside Landa/Komori with B1 digital devices suggests that there is a market for larger digital presses, albeit a niche one.

Heidelberg is a bellwether, so that it has introduced a B1 inkjet press, the Primefire 106 suggests there must be a need for it, especially when its partner is the equally mighty Fujifilm. Heidelberg’s sheet handling prowess and market reach combined with Fuji’s inkjet expertise look like a winning combination. The flipside of that is that no firm is infallible. While Heidelberg’s alliance with Ricoh for small toner machines is working well, its previous digital partnership, the Nexpress, never made it mainstream. The launch of the Primefire is cautious and controlled. Initial focus is niche packaging and some specialist sheet applications. The 2000 sheet per hour speed is slower than the Landa/Komori. Heidelberg’s argument is the market doesn’t need the speed, a counter argument is that with a vested interest in litho, it doesn’t want to make digital look too good. At the show take a close look at the print quality. There were no samples available to assess when it was unveiled.

HP’s Indigo 50000 is a 746 mm wide web, so it’s not strictly speaking B1, but for firms with high volumes of duplex work on a limited range of substrates this twin-engined machine promises to eat up work. HP Indigo is also positioning the single engine 20000, originally targeted at flexibles, for single sided work onto paper for digital jobs that need the larger format.

All eyes are on Landa this time to see if the presses, including the B1 sheetfed S10 deliver on the promises of 2012. Things have moved on a lot, and it appears there is something serious underneath all the hype worth taking very seriously. Expect dancing girls, dry ice and other distractions but look beyond those and focus on what the quality is like now, when it will be ready and what the economics are. For a more cautious approach compare and contrast Komori’s presentation of the Impremia NS40 based on nanography.

The HP Indigo 12000

B2

While B1 is where the hype is, it is in B2 where the action is. Machines shown in 2012 will actually be commercially available this time around, and those that were available last time have been tweaked and refined to take on board the experience of early adopters. HP claims 300 installs of its Series 4 machines (the B2 10000 and the web-fed 20000 and 30000, with the majority the 10000), while Fuji is up to 70 Jet Press 720S. Those figures show there is a market. Both those pioneers are showing enhanced machines that improve productivity, albeit without a mechanical speed increase, and enhanced material and application ranges. They now face more competition with Konica Minolta now shipping the KM-1. Delphax has also commercialised its more affordable B2 machine the Elan.

That means there are now four different technologies battling it out for B2: liquid toner, piezo inket, using water-based inks, piezo inkjet using UV inks and thermal inkjet using water-based inks. Whether all four are needed to address all the different applications, substrates and price points remains to be seen,

B3

Picking the right technology for B3 cut sheet production has got more complicated. Until recently, toner (including liquid toner/ElectroInk) was your only option. Xerox has upset the applecart with the launch of the Brenva – the love child of the transport systems from its Nuvera and iGen cut sheet toner technologies and Impika inkjet imaging. The result is interesting. It is aimed at cut sheet applications with low ink coverage, where inkjet offers a distinct financial advantage over toner. This is exactly the opposite of what Xeikon and HP are doing with liquid toner for high coverage applications, where inkjet inks become too expensive. Xerox’s combination of two existing technology platforms also overcomes a limitation of inkjet, that despite low operating costs (for low coverage) the systems have been much more expensive upfront. It’s a similar argument to Canon’s i300 (which sees some enhancements for drupa) albeit that machine is reel to sheet. The key question with either machine is do you have enough work that fits the bill in respect to coverage, quality and cost-effectiveness to make it pay, or do you need the versatility of a toner machine offering higher quality and a wider substrate range.

The Xerox Brenva

Other developments in B3 cut sheet are incremental. Kodak is introducing a white toner for the Nexpress, which may open up some new applications along with the tweaked 3900 platform. It will also preview a new Nexpress platform due in a year or so. HP has continued to evolve its machines with the 5000 and 7000 now reaching the 5900 and 7900 model numbers. The 7900 gains the One-Shot option, increasing the range of substrates it can handle, especially heat sensitive ones. There is also new on press priming and coating options. For many users the most interesting development – and a sign of the direction for many future developments – is the HP Indigo Optimizer software. This sits in front of the press and batches work by a number of parameters such as substrate and number of colours. By combining similar jobs it allows the press to print continuously for as long as possible without stopping or requiring operator intervention. HP claims it can improve productivity by up to 47% based on feedback from beta testers.

Wide format

Although wide-format is well served with dedicated events – this year Fespa Digital in Europe and ISA in the USA have already been and gone – there will still be a number of wide format developments getting their first airing at drupa. Fuji and HP have already announced a couple of high-end machines – the Fujifilm Uvistar Hybrid 320 and the HP Scitex 9000, a flatbed machine – that won’t be shown until drupa.

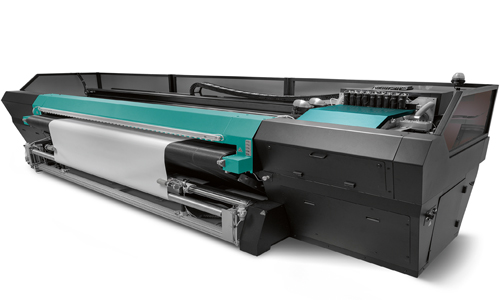

The Uvistar Hybrid 320 is a new platform, from an un-named supplier. The eight-colour machine can print up to 195 square metres per hour. Features include media feeding to enable continuous board printing and to eliminate media skew.

The Fujifilm Uvistar Hybrid 320

It carries the Uvistar brand but unlike previous machines is not made by EFI Matan. Other firms, including Durst and EFI, have been dropping heavy hints about big news at the show in this sector.

It is not just the big-ticket production systems either. HP will launch a pair of new Latex machines, the 560 and 570, which offer higher throughput than the 360 and 370 machines.