One of the first financiers to concentrate on the print industry, Close Brothers Asset Finance has been supporting the UK’s print operators for more than two decades. Commercial director Jon Bennett explains why it is uniquely positioned to help the industry invest in digital technology.

When Close Brothers Asset Finance was founded over 25 years ago, we dealt almost solely with the print industry.

Of course the company has grown significantly since then, but our expertise in print remains a core part of our DNA and today we are one of the UK’s leading providers of finance solutions to printing and graphics businesses.

As we have evolved, so has the print industry. Our customers are operating in an ever more competitive arena and to survive, many have elected for a more holistic approach to their business, offering value added services in addition to their core digital print activity.

Digital print is in a growth phase, and to meet the demand for these services, printing firms across the board will need to make a financial investment in their assets to keep ahead of the game.

As digital is still in a state of evolution, having up to date technology creates the competitive edge that businesses seek.

While economic recovery is underway, capital in the marketplace remains scarce and so investing in the future is easier said than done. When you cannot access credit from traditional sources, it is next to impossible to prepare for growth.

Asset finance presents a solution. In contrast to bank loans and overdrafts, it is a flexible, cost effective method of funding that allows the purchase of vital equipment with a low capital outlay, thus enabling you to invest.

At Close Brothers, we pride ourselves on our specialist knowledge and ability to focus on each individual customer, applying our expertise to create solutions that are truly tailor-made.

We know that one print firm is not the same as the next and we do not cherry pick the ones we will work with. Our customers go right across the spectrum of the print sector and we are noted for supporting smaller businesses as well as household names.

Our own success is based on building long-standing relationships with clients, generating mutual loyalty and trust as we go. The experience and challenges that our customers face inform what we do and how we do it.

It is through this interaction with our clients that we have recognised that more and more customers want to invest in digital technology and we are committed to giving them the means to do so.

We are renowned for our innovative approach to funding solutions, listening to what our customers want, and building a deal around that. For us, there is no substitute to sitting down in front of an individual business when it comes to understanding its exact requirements.

Whether you need to expand or replace equipment in order to meet that need, we can help. We offer straightforward Hire Purchase and Leasing as well as Sale and HP Back, a flexible product that allows a business to release capital from its existing assets, thus providing an instant boost to cash flow.

We can also restructure existing finance deals, taking over the financial commitments to reduce payments over a longer period of time, making growth achievable with no extra capital outlay.

The idea behind all our products is that you are able to move ahead, accessing and investing money in the area of the business that needs it the most.

Our USP is our ability to be creative and flexible in our attitude to lending, together with our unrivalled knowledge of the print industry, and speed of service.

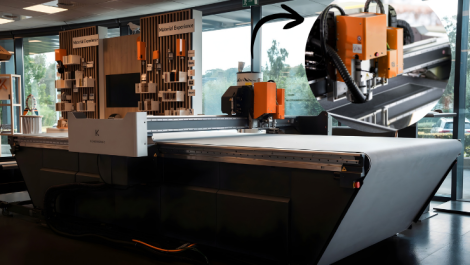

We can even fund the specialist finishing equipment that is essential to our customers, not just the digital presses themselves.

In 2013, we were awarded a significant allocation from the government’s Regional Growth Fund (RGF) and to date, we have made awards to over 87 print firms in the UK. The stipulation of accessing the RGF is that the business must commit to safeguarding or creating employment, and this figure stands at 381 jobs safeguarded or created.

Businesses that are interested in discussing RGF funding to generate a deposit for asset purchase should speak to us to find out more. We will explain the criteria for qualification and manage the process from beginning to end.

Ultimately our message is that we have the appetite to lend to printers who want to invest in digital technology, and we have the means to do so.