It is easy to talk about diversification and investment, but plans have to be backed up by financial wherewithal. Close Brothers Asset Finance is keen to help printers invest in digital equipment to support their growth.

Close Brothers Asset Finance, a subsidiary of Close Brothers Group plc, has been supporting the print and packaging industry since 1987.

Since then, it has worked hard to become the finance partner of choice for the print industry. It has a team of specialists operating throughout the UK, who apply their local experience and detailed knowledge of the industry to create sustainable finance packages.

This level of industry expertise and flexible funding solutions has allowed it to continue to support SMEs and larger businesses in recent years, despite challenging economic conditions. As part of an overall strategy, the focus in recent months has been on the digital print market.

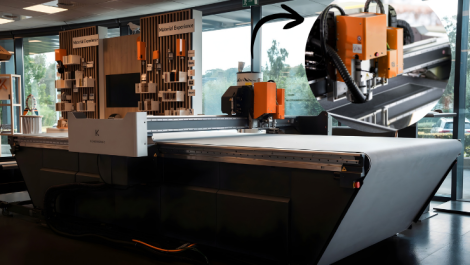

Business development director of the Print Division at Close Brothers Asset Finance, David Bunker said: ‘We recognise the need for firms to invest in digital and ancillary equipment and are keen to support this.

‘Historically, finance for digital machines has been provided by the manufacturer through vendor programmes; however, in recent months we have seen a considerable increase in the number of clients coming to us to fund small digital units for around £50,000. In response to this increased level of demand, we have adapted our approach to help more firms invest in this type of equipment.’

Commercial director of the Print Division at the company, Jon Bennett added: ‘Although our business is grounded in the traditional litho machinery market, we realise that our customers need to invest in the digital sector in order to move forward and so we have extended our flexible, common sense approach to funding in this sector.’ Close Brothers Asset Finance has also been awarded £15 million from the government’s Regional Growth Fund (RGF) to help UK SMEs via the Close Brothers Asset Purchase Scheme.

Through the scheme, businesses may be eligible for a grant, which goes towards the deposit on new assets. The size of the grant available is based on the scale and location of the business, the level of asset investment and the number of sustainable full-time jobs being created or retained.