Brexit effect: printers are still (just) positive. Source: BPIF

Reports from Close Brothers Asset Finance and the BPIF paint a mixed picture of print’s fortunes amidst political and economic uncertainty.

Times aren’t great for SME print business owners, with 40% seeing no growth between now and 12 months ago and a further 43% describing business as “worse than ever”, while only 7% are prospering. This is according to the Close Brothers Business Barometer, a quarterly survey of 900 small-to-medium business owners of various types across the UK.

Looking ahead, nearly two-thirds of print respondents expect no change in performance for the rest of 2017, while those who foresee an improvement and those who predict the opposite are split evenly at 17% each. Compared to results across all industries in the survey, which was conducted in December 2016, print had fared slightly worse, with two thirds – 67% – reporting that their businesses had not grown in the last year (versus 59% generally) and only 30% saying that it had (33% for all sectors).

This is in contrast to the BPIF’s most recent Printing Outlook survey which found that 45% of printers of its sample of 95 print firms of all sizes had increased their output in the first quarter of 2017. More than one third had held output steady during the quarter and only 18% had experienced a decline, giving the most positive Q1 report for three years and suggesting that the seasonal downturn that often follows the Christmas period has not happened this time.

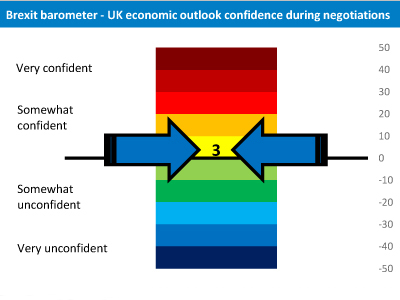

A very large majority expect business to continue growing (40%) or to remain steady (49%) in the next quarter, possibly thanks to the snap general election. While confidence has improved since the slump that followed the UK’s EU referendum result last summer, there is also a slight drop in confidence regarding the effect on the industry of Brexit, with those who are “somewhat confident” of the outlook for the UK economy during the two-year negotiation period falling from over a third to just under a quarter compared to the previous quarter, while almost half are neutral and one fifth are “somewhat unconfident”.

BPIF respondents are also concerned about competition, costs and profit levels. The biggest concern by far is competitive pricing, driven particularly by trade print websites, with respondents claiming that they are “undervaluing print”; rising paper and board prices are still on the radar, though less markedly than in Q4 2016, and profit levels being inadequate to support sustained investment has taken over from access to skilled labour as the third-ranked concern.