Messe Dusseldorf’s post-drupa survey shows an unexpected litho resurgence and drops in variable data printing and web-to-print deployment, although inkjet and wide-format are growing fast.

Last October drupa organiser Messe Dusseldorf sent out two questionnaires to analyse the economic health of printers and suppliers, receiving almost 1200 responses. Forty two per cent of European companies described their business as in a ‘good’ economic state, whilst 11% described it as ‘poor’, giving a positive net balance of 31%. The projected forecast for 2017 stands at 41%, although this may be an over-optimistic prediction.

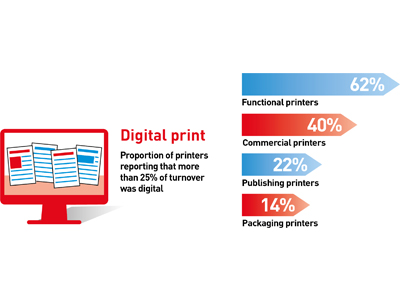

Past trends continued: ever-shorter run lengths, lead times and an increasing number of jobs. However, for the first time there was a small reduction in digitally printed turnover.

The proportion of variable data print has dropped too: in 2013, 19% of printers reported more than 25% of their digital print was variable, while the figure for 2016 is 18%. The proportion of printers who offer web-to-print/storefront services has also fallen by 3% globally, including a 25% fall in the US.

Inkjet is the dominant print technology for most applications in functional markets (61% in 2014, up to 74% in 2016) and planned investment in digital inkjet roll-fed colour accounts for 36% of budgets, followed by cut-sheet (27%) and toner cut-sheet colour (20%).

The report shows no growth in the commercial print sector, with the exception of wide format: up 13% since 2013. Multi-channel is still a minority application at 18% globally.

The publishing industry continues to prioritise sheetfed offset, which takes 30% of investment budgets. Encouragingly, the number of titles lost to online-only editions remains very low. Personalisation, versioning and variable content are growing, albeit slowly.

Digital print is starting to have a real impact in packaging, however: 32% offer it globally, most commonly for labels but with flexibles and folding cartons following and some signs of uptake for corrugated. Flexo and sheetfed are still the main investment technologies, pushing digital into joint third place, along with hybrid technology.

Universally, investment in finishing is now the top priority, closely followed by print technology. However there is greater investment in prepress/workflow/MIS as printers begin to realise the need for more automation.

Finding new customers was the most difficult challenge for printers, who advocate reduced staffing/improved productivity and new print technology as the solution to profitability. Suppliers struggle with competitive pricing, and will rely on new products and new sales channels to boost business.