The BPIF’s Printing Outlook report for Q1 2021 suggests that printers’ confidence for the start of the new year has taken a dive, based on a reversal during the closing three months of 2020 of the general recovery seen in the previous quarter, with Coronavirus almost entirely to blame, though Brexit-related factors are creating concerns for some.

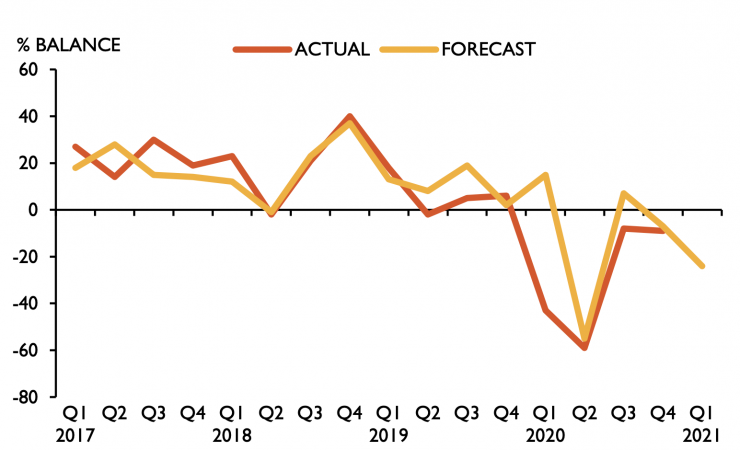

The survey, which reflects the printing and printed packaging industries, showed that 29% had managed to increase output levels in Q4 of 2020, against 38% seeing a decline, while one third held steady, a net balance of -9. This was a little worse than the net -8 for Q3 and the -7 predicted for Q4, and the first time a fourth quarter, usually the best of the year, has returned a negative figure, as well as the first time the figure has been negative for four consecutive quarters.

The outlook for the first quarter is on balance strongly negative at -24, with only 21% expecting to increase output against 45% expecting to see it drop, while just over one third (34%) expect to hold steady. The BPIF notes that this does include a normal seasonal downturn in packaging. Although the roll-out of Covid-19 vaccines was underway when the survey was conducted, the government’s prospective timetable for relaxing restrictions had not been announced (and may yet not be adhered to), and there seems to be no net anticipation of improvement during Q1.

Dealing with the impact of Covid-19 therefore unsurprisingly remains the primary business concern, selected by 62% of respondents, with 44% also being worried about the survival of major customers. Competitor pricing below costs has also made a reappearance in the top three concerns, also cited by 44%.

Brexit presents a mixed picture, with supply chain security after the UK’s severance from the EU trading bloc being the most widely-voiced concern (60%), though recognition of non-tariff barriers not addressed in the ongoing trade agreement is a relatively close second at 55%, while general cost inflation (49%) is a not too distant third.

The flip side of this is that more work may return to British shores because of increased costs or other difficulties in placing work in the EU, seen as the top-ranked opportunity by 48%, with popular support from customers for British businesses second at 47%. The third – and perhaps optimistic – opportunity was seen as increased government support for small and medium sized businesses, selected by 28%, though 23% saw no opportunities in Brexit.

As might be expected, views on the impact of Brexit varied widely according to how much involvement in / exposure to EU business printers had, with those not exporting being unconcerned as long as supplies and costs continue unaltered, while those in or trading with Northern Ireland or the EU reported facing various disruptions and difficulties.

BPIF economist Kyle Jardine commented, ‘The economic climate has been challenging – high levels of debt will force adjustments, and investment (weak for a while now) will require support if productivity is to improve. However, the high level of uncertainty should start to fade as the vaccine roll-out progresses and businesses progress past the Brexit-related turmoil.’